Economic Impact

Petro dollar saudi arabia – The petrodollar system has been a cornerstone of Saudi Arabia’s economy for decades. The arrangement, which effectively ties the value of the US dollar to the price of oil, has allowed Saudi Arabia to accumulate vast wealth from its oil exports.

Saudi Arabia’s petrodollars have long been a source of intrigue and power, fueling economic development and shaping global politics. But as the world grapples with the transition to renewable energy, the future of petrodollars hangs in the balance. Like the unpredictable twists and turns of the boys season 3 , the fate of petrodollars remains uncertain, casting a long shadow over the global economic landscape and leaving the future of Saudi Arabia and its vast oil reserves in question.

Oil exports account for a significant portion of Saudi Arabia’s GDP. In 2021, oil revenues accounted for approximately 70% of the country’s GDP. This reliance on oil exports has made the Saudi economy highly susceptible to fluctuations in oil prices.

Foreign Investment Strategy, Petro dollar saudi arabia

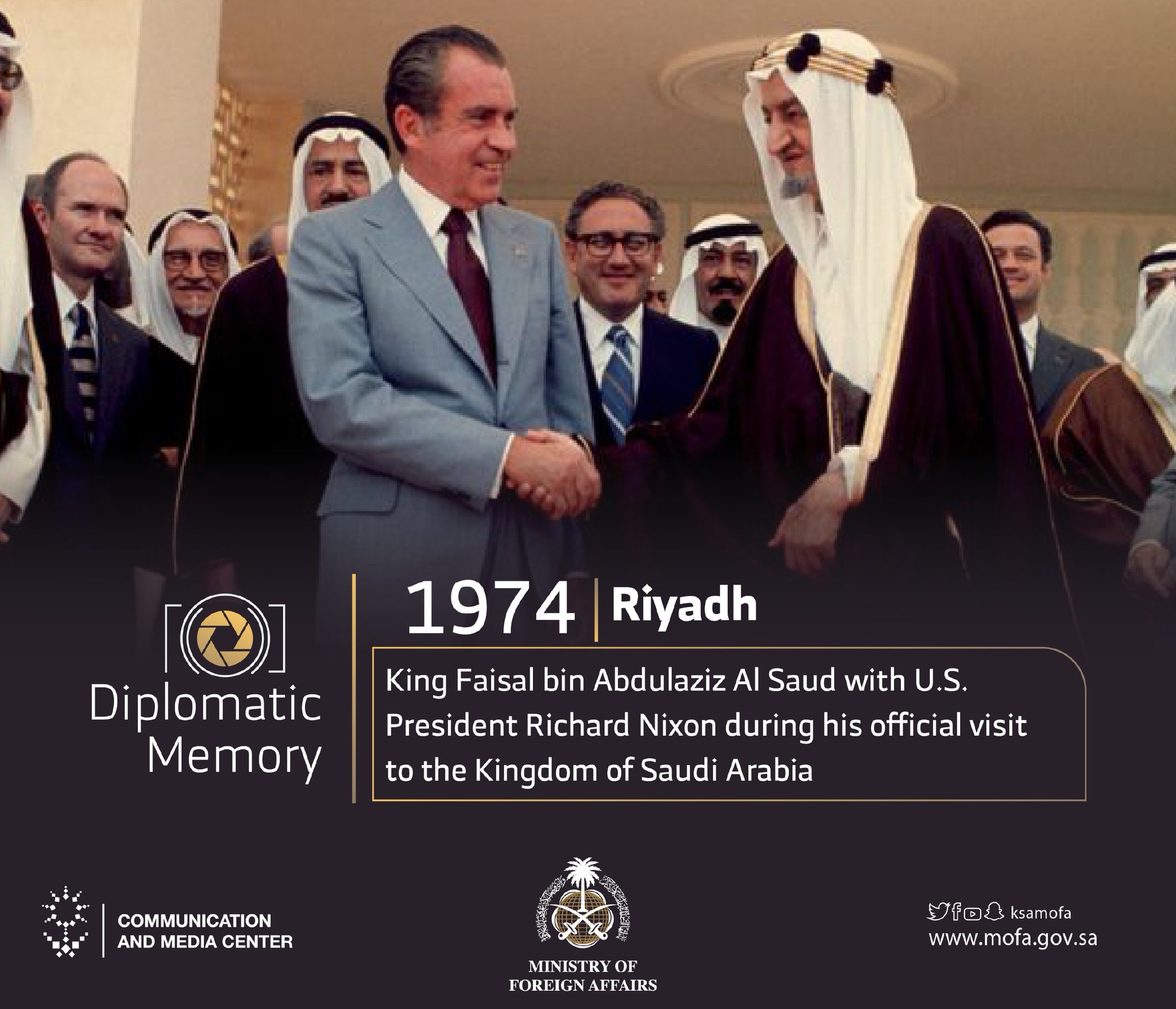

The petrodollar system has also influenced Saudi Arabia’s foreign investment strategy. The country has invested heavily in the United States, particularly in Treasury bonds and other financial assets. These investments have helped to strengthen the US-Saudi relationship and have provided Saudi Arabia with a safe haven for its oil wealth.

The petrodollar system, with Saudi Arabia at its heart, has played a pivotal role in shaping global economics. However, amidst this financial landscape, a different kind of collectible has emerged as a symbol of Americana: the josh gibson baseball card.

This iconic piece of sports memorabilia serves as a reminder of a time when legends like Josh Gibson graced the baseball diamond. As the petrodollar system continues to evolve, it remains intertwined with the cultural and historical tapestry of our world, forever etched in the annals of both economics and sports.

Geopolitical Implications

The petrodollar system has played a significant role in shaping Saudi Arabia’s regional and global influence. By controlling the flow of petrodollars, Saudi Arabia has been able to exert political power and influence the policies of other countries.

For example, Saudi Arabia has used its petrodollar wealth to support its allies and punish its enemies. In the 1970s, Saudi Arabia provided financial assistance to Egypt and Syria to support their efforts in the Arab-Israeli conflict. In the 1980s, Saudi Arabia cut off oil supplies to the United States in response to its support for Israel.

The petrodollar system has also given Saudi Arabia a voice in international affairs. Saudi Arabia is a member of the United Nations Security Council and the Organization of Petroleum Exporting Countries (OPEC). Through these organizations, Saudi Arabia has been able to influence global energy policy and promote its own interests.

However, the petrodollar system is facing challenges. The rise of alternative energy sources, such as solar and wind power, is reducing the demand for oil. This could lead to a decline in the value of the dollar and a decrease in Saudi Arabia’s influence.

Potential Consequences of a Shift Away from the Petrodollar System

A shift away from the petrodollar system could have significant consequences for Saudi Arabia’s geopolitical standing. Saudi Arabia would lose its ability to control the flow of petrodollars and its influence over other countries would diminish. This could lead to a decline in Saudi Arabia’s regional and global power.

In addition, a shift away from the petrodollar system could lead to economic instability in Saudi Arabia. The Saudi economy is heavily dependent on oil revenues. If the value of oil falls, Saudi Arabia’s government will have less money to spend on social programs and infrastructure. This could lead to social unrest and political instability.

Future Prospects: Petro Dollar Saudi Arabia

As Saudi Arabia embarks on its transition away from oil dependence, it faces both challenges and opportunities. The challenges include the need to diversify the economy, create new jobs, and reduce reliance on foreign workers. The opportunities include the potential to develop new industries, such as tourism, manufacturing, and renewable energy.

The future of the petrodollar system is uncertain. Some experts believe that the system will continue to be the dominant global currency for years to come. Others believe that the system is in decline and will eventually be replaced by a new currency system. The implications of these different scenarios for Saudi Arabia are significant.

Challenges and Opportunities

Saudi Arabia faces a number of challenges as it transitions away from oil dependence. One of the biggest challenges is the need to diversify the economy. The country has a long history of relying on oil revenues, and this has led to a lack of development in other sectors of the economy. Saudi Arabia needs to develop new industries and create new jobs in order to reduce its reliance on oil.

Another challenge is the need to create new jobs. The Saudi population is growing rapidly, and this is putting pressure on the government to create new jobs. The government is investing in education and training programs to help Saudi citizens find jobs in the private sector.

Saudi Arabia also needs to reduce its reliance on foreign workers. The country has a large number of foreign workers, and this is putting a strain on the country’s resources. The government is implementing policies to encourage Saudi citizens to take jobs that are currently held by foreign workers.

Despite these challenges, Saudi Arabia also has a number of opportunities as it transitions away from oil dependence. One of the biggest opportunities is the potential to develop new industries. The country has a number of resources that could be used to develop new industries, such as tourism, manufacturing, and renewable energy.

Saudi Arabia also has the opportunity to create new jobs. The country has a large population of young people, and this is a potential source of new workers. The government is investing in education and training programs to help young people find jobs in the private sector.

Finally, Saudi Arabia has the opportunity to reduce its reliance on foreign workers. The country has a number of policies in place to encourage Saudi citizens to take jobs that are currently held by foreign workers.

Scenarios for the Future of the Petrodollar System

The future of the petrodollar system is uncertain. Some experts believe that the system will continue to be the dominant global currency for years to come. Others believe that the system is in decline and will eventually be replaced by a new currency system.

The following table compares different scenarios for the future of the petrodollar system and their implications for Saudi Arabia:

| Scenario | Implications for Saudi Arabia |

|---|---|

| Petrodollar system continues to be the dominant global currency | Saudi Arabia will continue to benefit from its oil revenues. The country will be able to use these revenues to develop new industries and create new jobs. |

| Petrodollar system is replaced by a new currency system | Saudi Arabia will need to find new ways to generate revenue. The country may need to diversify its economy and develop new industries. |

Recommendations for Saudi Arabia

Saudi Arabia can take a number of steps to mitigate the risks and maximize the benefits of a post-petrodollar era. These steps include:

- Diversifying the economy

- Creating new jobs

- Reducing reliance on foreign workers

- Investing in education and training

- Implementing policies to encourage Saudi citizens to take jobs that are currently held by foreign workers

By taking these steps, Saudi Arabia can position itself for success in a post-petrodollar era.

The petrodollar system, with Saudi Arabia as a key player, has faced recent economic challenges. While Waterville, Maine, has experienced the closure of its JCPenney store as reported , the global economy continues to grapple with the implications of the petrodollar’s influence.

Saudi Arabia’s petrodollar system has been the cornerstone of its economy for decades. The kingdom’s vast oil reserves have given it immense power and influence in global affairs. Laz Alonso , the acclaimed actor known for his roles in “Fast & Furious” and “The Boys,” has spoken out about the importance of Saudi Arabia’s petrodollar system in maintaining stability in the Middle East.

Despite recent challenges, the petrodollar system remains a crucial factor in the global economy.

Saudi Arabia’s petrodollar dominance has shaped global economies for decades. Amidst this financial landscape, a glimmer of sports history shines through with the iconic Josh Gibson baseball card. This card, valued at millions, captures the essence of a legendary player who transcended racial barriers in baseball.

Its significance mirrors the transformative power of petrodollars, which have fueled nations and propelled dreams, leaving an enduring legacy in both finance and sports.